“Can I take the home office deduction with my RV office space?” or “Can I claim the home office deduction on my taxes with my Airbnb office spaces as I travel?” I get these questions all the time from digital nomads, full-time RVers, and full-time boaters who live and work on the road from their RV, boat, or rentals and are looking for ways to save money on their taxes.

This is an easy question to answer. Below, we walk through how you can determine if you can claim the home office deduction as a full-time RVer or digital nomad and then we share the steps of how to take the deduction on your tax return.

Before we get into it, the IRS states a home is anywhere with a toilet, a bed, and a kitchen, so in this article we’ll be referring to a “home” office, but your home office could be the space you work from in your RV, boat, or Airbnb rental where you’re staying. Whether it’s a sticks and bricks home or your RV, in this article, we’ll refer to it as your “home” office.

Alright! Let’s go!

Other tax deductions you may qualify for:

Disclaimer: The information and materials we share are intended for reference only. As the information is designed solely to provide guidance, it is not intended to be a substitute for someone seeking personalized professional advice based on specific factual situations. Therefore, we strongly encourage you to seek the advice of a professional to help you with your specific needs.

Watch my explanation on YouTube:

How to Claim the Home Office Tax Deduction as a Full-Time RVer or Digital Nomad

1. Does Your Office Space Qualify for the Home Office Deduction?

Our first question for you is: Is your home office space exclusively used for work?

In order to take the home office deduction, the IRS states your office space must be exclusively used for work and nothing else.

As a personal example, we live in our Casita Travel Trailer with 96 square feet of living space. We have a dinette table we work from during the day but we can’t claim that space as exclusive office space because we also use it for personal reasons like having meals at the table or doing personal work at the table. So for our office situation, we don’t take the home office deduction with our travel trailer’s work space.

If you were to claim a space that isn’t solely used for work, there could be consequences. You can see this with an RV couple in their case with the IRS, the Dunford case. The case hammers home that your home office must exclusively be used for work and nothing else. The Dunford’s lived and worked from their class C motorhome and claimed the home office deduction and were audited by the IRS. When the IRS agent investigated their RV, they stated that the desk they claimed to be their “home office” could not solely be used for work in their small living and working space and rejected their home office deduction claim on their taxes.

However, it is possible to have a home office exclusively used for work in your RV or boat or a room in your Airbnb as you travel to different countries. It’s also possible to claim the deduction for multiple home offices you work from during the year. If this is you and you decide to take the Home Office Deduction, it’s important to document and keep a record of proof of your office space with pictures or video and save these files with your tax return records just in case you need to defend your deduction in the future.

2. How to Document Your Work Space

It’s really important to always have detailed records as good reference and proof of your home office being exclusively used for work for your tax return. You may not have access to this same space if you’re questioned several years down the road.

To record your office space, here are things to capture in case you’re questioned about your deduction.

Take pictures or video of the area and how you only use the space for work.

A good idea is to take pictures or video of the door or partition (like a curtain) that shows the separation of your work space and your living spaces. This is helpful to show proof of the separation of spaces so the IRS agent can see that when you open the door or partition you’re entering your work space and you’re going to work. By closing the door or curtain, this shows that when you leave your office space, you leave work.

Make sure to save these photos or video with the rest of your tax return files for proof of your home office deduction later if you need it.

3. How do you make the Home Office deduction on your tax return?

There are two methods to calculate your home office deduction. You can either use The Simplified Method or The Actual Expenses Method. We walk through how to do each of these below.

Option 1: The Simplified Method

The simplified method is simple. The deduction is equivalent to the square footage of your home office multiplied by $5.

Here are the steps to do the Simplified Method:

Measure the total square footage of your office space.

Multiply the total square footage of your office space by $5.

If you’re a sole proprietor, put this number as your deduction amount on Schedule C, Line 30 of your tax return (expenses of business use for your home). Congrats! You’ve taken the home office deduction.

As an example, if your home office is 40 square feet, you’ll multiply 40 square feet x $5= $200. You’ll put $200 on the form Schedule C, Line 30 to claim the home office deduction.

A quick reminder: Make sure to add proof of your home office with pictures or video and your calculations of square footage to your personal tax return documentation. You may need to prove your deduction in the future.

Option 2: The Actual Expenses Method

The Actual Expenses Method is more complicated and more work than the Simplified Method, but may be more tax advantageous for you. This method requires more detailed documentation for all the of the expenses you incurred during the year for your RV, boat, or Airbnb spaces. However, you may be able to record a bigger deduction for your home office if you take the time and detail to do the Actual Expenses Method because you’re recording more expenses during the year.

How does the deduction work?

With the Actual Expenses Method, you can deduct a percentage of your home expenses for the year based on the percentage of space your home office takes up in your home. But it’s not that simple. You have to categorize your home expenses based on their relationship to work.

Here are the steps to do the Actual Expenses Method:

1. Measure the total square footage of your home.

2. Measure the total square footage of your home office.

3. Determine the percentage of your home that’s taken up by your home office.

An example is you live in an RV that’s 500 square feet. Your office in the RV is 50 square feet. This means your home office takes up 10% of your home’s square footage.

4. Now, for all of your office expenses and home expenses for the year, categorize each into one of three categories: Direct Office Expenses, Indirect Office Expenses, or Not Related Expenses. Here's more details on each category.

Direct Office Expenses: These are any expenses directly related to work. For example, your office chair, your computer stand, or your mouse. For direct office expenses, you can claim 100% of these expenses in the home office deduction.

Indirect Office Expenses: These are any expenses for your home or RV that are indirectly related to your home office but help run your home and in suite, help you maintain your home office. Examples include expenses for utilities, paint, repairs on the home, or RV tires. For indirect office expenses, you can claim a percentage of these expenses. In our example above since the home office is 10% of the RV, you can claim 10% of these expenses with the home office deduction.

Not Related Expenses: These are any expenses not related to work at all. Examples include, bedding for the bed or an outdoor rug. These items aren’t related to work at all and cannot be claimed as part of the deduction.

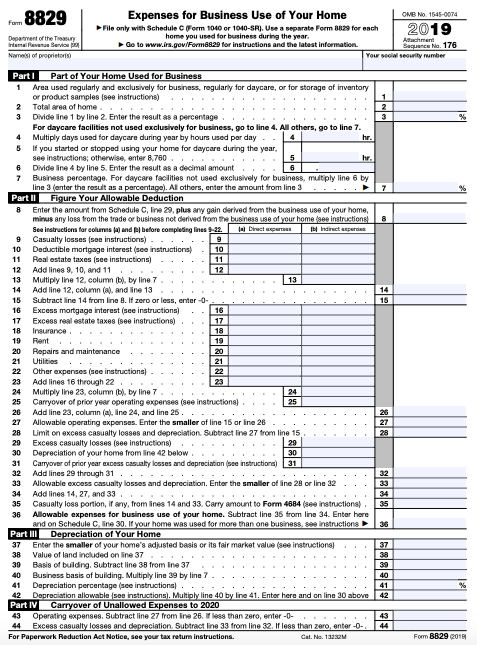

5. If you’re a sole proprietor, to take the deduction on your tax return, you’ll complete Form 8829. On this form, you’ll include all the square footage measurements you did in Steps 1, 2, and 3. You’ll also input all the categories of expenses from Step 4.

6. Then, you’ll take Form 8829’s information and insert it on Form Schedule C, Line 30 (expenses of business use for your home).

Congratulations! You’ve claimed the home office deduction with the Actual Expenses Method.

As a reminder, keep a record of all of your expenses and their receipts and how you categorized each one with your tax return files. Also, add your proof for your home office of pictures or video, too.

For reference, here’s what Schedule C and Form 8829 look like.

Schedule C:

Form 8829:

Using Multiple Home Offices in a Year?

If you’re traveling around a lot throughout the year and working from several home offices on your travels, you can claim multiple home offices as long as each home office is exclusively used for work like we shared earlier.

For example, maybe you live in your RV and work out of your home office and then decide to go to Europe for several months and you rent spaces with two rooms so you can use one room exclusively for an office. If the spaces are exclusively used for work, you can claim multiple home offices.

However, claiming multiple home offices is more complicated. Essentially, you associate a percentage of your net income from your business to each home office. Also, the home office deduction can’t make a net loss, so you have to look out for this, too. If you have questions on this, please connect with me here and we can walk through it together.

Save this for later!

Doing your taxes later? Download this information on our worksheet to remember how to make this deduction later when you’re doing your tax return.

Have a Question?

Heyo! I’m Adam Nubern, a digital nomad CPA. I hope this information is helpful for you. If you have any questions, please snag a time here and we can chat through your questions together.